|

Home | Reports and Services | News | AV Panel | Contact| Unsubscribe | |

September 2011

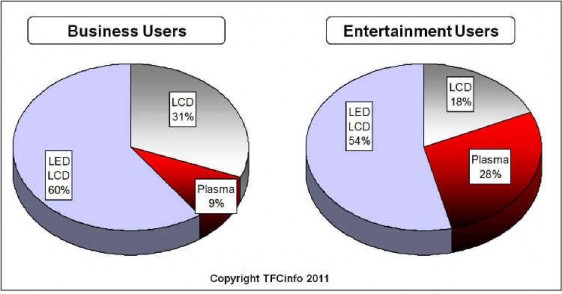

LED LCD Is The Technology Of Choice For Future Flat Panel Purchases, However Some Big Differences In Motivators For Each Technology Exist Which Could Change The GameTFCinfo's recent Flat Panel Brand Customer Perception and Preference Tracking Study 2011 compares and contrasts the business and entertainment segments in a detailed analysis of the flat panel market. This research reveals that there are some big differences between the market segments in the major motivators behind each technology. As end users weigh their most important characteristics desired with these motivators, the final purchase decision could be affected. *If you were to purchase a flat panel display, which technology would you choose? Overall picture quality and some aspects within the image quality spectrum are motivators behind future LED LCD purchases in entertainment. Some of the highest rated reasons for choosing an LED display include picture quality, contrast, resolution, lower power consumption and thinner panel. These findings are interesting as LED backlighting, lower power consumption, and thinness of panel were some of the least important things considered when purchasing a flat panel by entertainment end users in this study. The technical aspects are driving corporate end users to LED LCDs. The top three reasons for choosing an LED LCD are lower power consumption, No burn in issue (clearly burn in issues with plasma are still apparent in the pro market), and a thinner panel. Currently most ultra thin displays are still intended for the consumer realm. Professional displays are expected to do more and have different logistical needs than in the home. In the corporate world considerations for cabling, mounting, locking, and the capacity for cooling have to be considered. While a high percentage of professionals would prefer purchasing an LED LCD, it may be some time before this shift would eventually be able to take place. LCD is a more suited option at this time for professional use. While there is greater desire for an LCD in the corporate world, the reasons behind choosing an LCD does not differ between business use and home use purchasers. End users state they would choose an LCD because of price, lower power consumption and no burn in issues. Increasing price competitiveness has greatly helped LCD, and in some ways end users are choosing LCD technology because of perceived plasma burn in and reliability issues. This indicates that much of LCD's success has been due in part to the failure of plasma display makers to convey improved reliability to the public, especially among home users where plasma remains popular. The top three motivators behind plasma purchases for entertainment use are overall picture quality, contrast, and having a wider viewing angle. These top three motivators are real and major factors considered when purchasing a flat panel display for home use. TFCinfo's recurring annual flat panel study analyzes important purchasing factors, price sensitivities and premiums for sizes and upgrades, preferences on channel, purchasing location, influencers, brand performance (awareness, use, affinity and associations), and much more. Contact Tanya Lippke, 207-783-0055

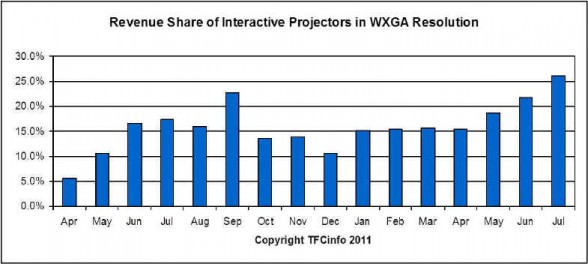

Interactive Projectors Gain Revenue Share helped by Seasonal Education Purchases

Interactive white boards have become very popular in the K-12 education market and are also used in business, but their sales have been restrained by their high cost. In 2010 projector manufacturers introduced projectors capable of replicating the interactive abilities of electronic white board projector combinations without the expense of the white board. These new interactive projectors have gained market-share since their introduction, particularly during the summer periods of stronger education purchasing. The table below based on data from TFCinfo’s Monthly Projector Market Analysis Reports shows the increasing revenue share of interactive models among WXGA resolution projectors, which reached a new high in July of 2011. Contact Dr. Jeffrey MacDonald, 512-715-0373 K-12 Video Display End Users Possibly Unaware Of Cheaper Alternative To Interactive Whiteboards

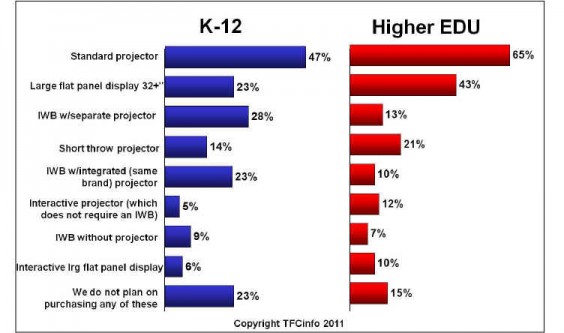

TFCinfo's recent research report on The Use of Video Displays in Education 2011 (K-12 and Higher EDU) highlights some interesting findings when it comes to future purchase intent of various video displays.

With the trend of downward pricing, in price sensitive markets such as education, investing in more AV technology is finally a possibility for more schools. The need to improve the learning process and enhance the educational experience continues to drive AV purchases and has turned educational institutions into an important market for our industry.

*Which of the following displays does your institution plan to purchase in the next 12 months?

This research shows that interactivity is becoming increasingly important to the educational initiatives in K-12 and interactive applications are in demand for all educators who want to involve their students and use learning with technology as a tool. K-12's strong figures for interactive whiteboards, and low figures for interactive projectors is quite interesting. This suggests that K-12 is continuing to move to interactive whiteboards for their needs and are perhaps unaware of interactive projectors as a cheaper alternative (surprising in comparison with the strong interest and premiums seen for interactive projectors in this research report).

The large intent to purchase flat panels for higher education is potentially disturbing for projectors, however these are likely for digital signage and entertainment applications, rather than classroom use.

Projectors deliver on many of the important aspects that purchasers are looking for in a video display for classroom use. Projectors offer the largest display, at an affordable price, without taking up precious classroom space, while interactive whiteboards provide the interactivity that is so strongly desired for educators. Moving forward there is great business potential in the education market. TFCinfo's report shows that in K-12 the focus will primarily be on projectors and interactive whiteboards, while in higher education the focus will be on projectors and flat panel displays.

TFCinfo's 260+ page report on The Use of Video Displays in Education 2011 compares similarities and differences between K-12 and higher education. The report provides detailed conclusions of the overall market, the purchase process for video displays, install base, brand usage, future purchasing, important product characteristics and much more.

Contact Tanya Lippke, 207-783-0055 Other TFCinfo End User Marker Research Studies Now Available

US Projector Brand Customer Perception and Preference Tracking Study 2012 Recurring

annual US projector customer preference study. Major

Multi-Client US Projector Perception Study with a focus on brand

preferences exhibited. Analyzes preferences on channel,

purchasing location, influencers, brand performance, brand

affinity, brand associations, and user preferences among projector

users and purchasers in the US. Research is

conducted across the five most important market segments: large

corporations, small-and-medium sized businesses, small office and

home users, government, and education. This is the 11th year of

this research.

The Use of Video Displays in American Churches 2012 Major

Multi-Client Study. Everything needed to understand

the rapidly growing house of worship market segment focusing on

projectors, LCD, and plasma displays. HOW unique needs, brand

preferences, how to build effective communication and advertising

strategies for HOW market, how to sell and to whom, best

practices, and much more!

TFCinfo has brochures and outlines available for all end user research reports. If you would like more information about purchasing any of the reports or services offered by TFCinfo please contact Tanya Lippke, director of survey market research, by email tmlippke@tfcinfo.net, or by phone (207) 783-0055.

|

IMPORTANT: TFCinfo respects the personal nature of e-mail communication. Every

effort is made to offer only information that may be of value to you or

your business. If you do not wish to receive display news e-mail from TFCinfo in the future,

you may unsubscribe.

If you would like to change your

e-mail address in our database, please click

here.

TFCinfo

20 Edward Ave.

Lewiston, ME 04240